SARIMAX#

The (extended) ARIMA family of methods is too big to be properly explained in this course.

At NMBU, the course DAT320 goes deeper and explains the data generating processes.

An online book with videos: Forecasting: Principles and Practice.

We therefore skip (almost) directly to the regression models (inspired by phosgene89’s GitHub page, except for their errors) and their usage.

But first we introduce a dataset and the concepts of stationarity and autocorrelation.

Stationarity:

The distribution of the time series is independent of which part of the time series you look at.

Trends, seasonality (cycles of fixed width) and changes in variance lead to non-stationarity.

Differencing (first or second order discrete derivatives) can help.

Seasonal differencing means the difference is not between neighbours but higher lags.

If the data is not stationary, pre-processing or modelling of the specific deviations from stationarity is needed.

Wholesale price index (WPI) data#

We will illustrate some concepts and models using the WPI data.

# Imports

import numpy as np

import pandas as pd

import statsmodels.api as sm

import matplotlib.pyplot as plt

import requests

from io import BytesIO

# Load Wholesale price index (WPI) data

wpi1 = requests.get('https://www.stata-press.com/data/r12/wpi1.dta').content

data = pd.read_stata(BytesIO(wpi1))

data.index = data.t

data['ln_wpi'] = np.log(data['wpi'])

data['D.ln_wpi'] = data['ln_wpi'].diff()

# Set the frequency to Quarterly Start, year ending October

data.index.freq="QS-OCT"

data.head()

| wpi | t | ln_wpi | D.ln_wpi | |

|---|---|---|---|---|

| t | ||||

| 1960-01-01 | 30.700001 | 1960-01-01 | 3.424263 | NaN |

| 1960-04-01 | 30.799999 | 1960-04-01 | 3.427515 | 0.003252 |

| 1960-07-01 | 30.700001 | 1960-07-01 | 3.424263 | -0.003252 |

| 1960-10-01 | 30.700001 | 1960-10-01 | 3.424263 | 0.000000 |

| 1961-01-01 | 30.799999 | 1961-01-01 | 3.427515 | 0.003252 |

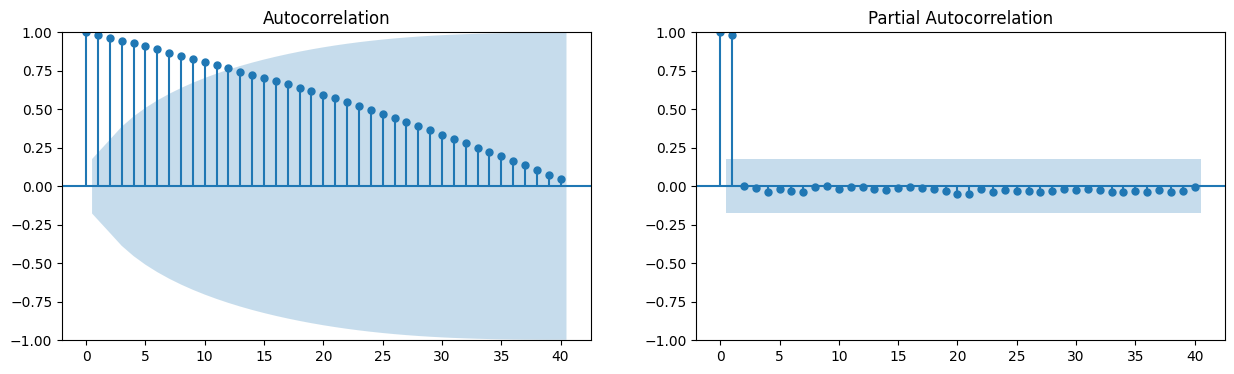

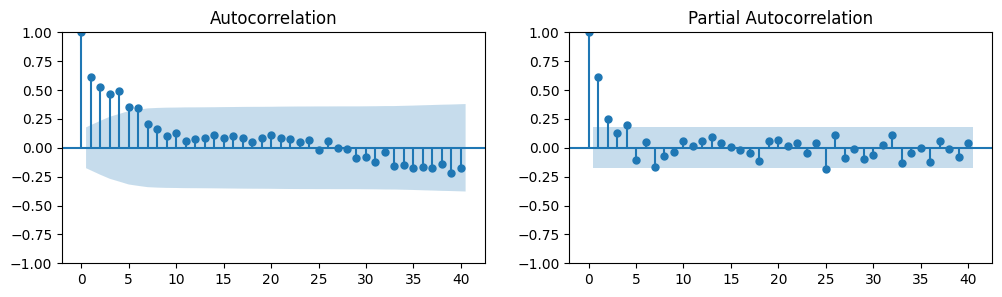

Autocorrelation#

Autocorrelation is the correlation between a stationary timeseries and a lagged version of itself.

This is a measure of the time dependence in the series, i.e., lack of independence.

Can be used to indicate the appropriate lag in moving average (MA) models.

Partial autocorrelation is the autocorrelation when controlling for (regressed on) all intermediate time lags.

Can be used to indicate the appropriate lag in autogregressive (AR) models.

# Autocorrelation and partial autocorrelation plots (raw data)

fig, axes = plt.subplots(1, 2, figsize=(15,4))

fig = sm.graphics.tsa.plot_acf(data.iloc[1:]['wpi'], lags=40, ax=axes[0])

fig = sm.graphics.tsa.plot_pacf(data.iloc[1:]['wpi'], lags=40, ax=axes[1])

# Graph data

fig, axes = plt.subplots(1, 2, figsize=(12,3))

# Levels

axes[0].plot(data.index._mpl_repr(), data['wpi'], '-')

axes[0].set(title='US Wholesale Price Index')

# Log difference (attempting to improve stationarity)

axes[1].plot(data.index._mpl_repr(), data['D.ln_wpi'], '-')

axes[1].hlines(0, data.index[0], data.index[-1], 'r')

axes[1].set(title='US Wholesale Price Index - difference of logs');

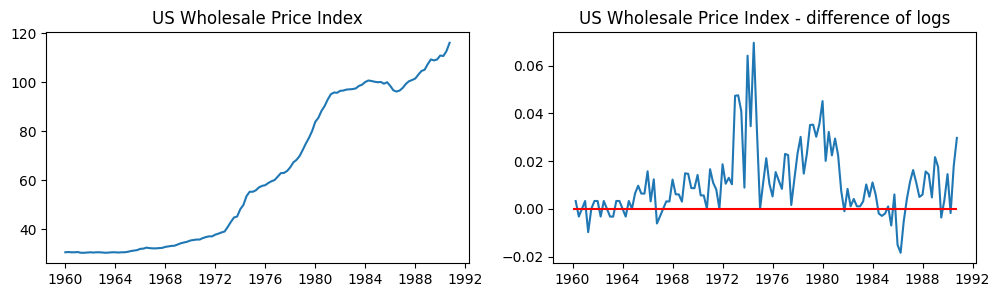

# Autocorrelation and partial autocorrelation plots

# after applying the logarithm and differencing

fig, axes = plt.subplots(1, 2, figsize=(12,3))

fig = sm.graphics.tsa.plot_acf(data.iloc[1:]['D.ln_wpi'], lags=40, ax=axes[0])

fig = sm.graphics.tsa.plot_pacf(data.iloc[1:]['D.ln_wpi'], lags=40, ax=axes[1])

Autoregressive models in Python#

Using the statsmodels package, the most complex model is the starting point.

Setting the various parameters of \(SARIMAX(p, d, q)(P, D, Q, s)\), we can obtain any of the below mentioned models.

SARIMAX(endog, exog=None, order=(1, 0, 0), seasonal_order=(0, 0, 0, 0), trend=None, …)

For integer values of \(p/d/q/P/D/Q\), all lags up to the integer are included. For more fine-grained control, lists can be applied, e.g., [1,0,1] includes lags 1 and 3, but not 2.

There are also various other parameters, e.g., a trend (none, constant, linear, quadratic, polynomial).

Lag operator#

Back-shift \(n\) time points, i.e., extracts the measurement \(n\) time points before \(t\). $\(L^{n} y_{t} = y_{t-n}\)$

Also noted as \(B^{n}\) in some litterature.

Combined with a vector of parameters \(\Psi\), we define a polynomial function $\(\Psi(L)^n y_t = y_t + \psi_1 y_{t-1} + \psi_2 y_{t-2} + ... + \psi_n y_{t-n}\)$

This will enable compact notation of the SARIMAX models, exchanging sums with the polynomial function.

AR - autoregressive models#

For a (single variable) timeseries given by \(\{ y_{t} \}\), we can specify the \(AR(p)\) model as:

i.e., the current time is a function of \(p\) previous time points and a constant.

Here, \(\theta_0\) is a constant, \(\theta_{i}\) is the coefficient for the \(p\)-th time lag and \(\epsilon_{t}\) is the error.

This can be thought of as stacking subsets of a time series using a moving window and performing ordinary least squares on the resulting matrix/dataframe.

In practice, the fitting is performed using maximum likelihood, so performing ordinary regression will not give exactly the same results.

Using the lag operator, \(L^{n} y_{t} = y_{t-n}\), we can redefine the above equation in the form of a polynomial function, \(\Theta(L)^{p}\) (signs of coefficients will change) as:

# Fit an AR(1) model (badly specified due to non-stationarity)

mod = sm.tsa.statespace.SARIMAX(data['wpi'], trend='c', order=(1,0,0)) # trend='c' adds a constant

res = mod.fit(disp=False)

print(res.summary()) # AIC gives us a measure of fit for comparison

SARIMAX Results

==============================================================================

Dep. Variable: wpi No. Observations: 124

Model: SARIMAX(1, 0, 0) Log Likelihood -201.927

Date: Mon, 24 Nov 2025 AIC 409.855

Time: 09:18:46 BIC 418.316

Sample: 01-01-1960 HQIC 413.292

- 10-01-1990

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

intercept 0.0293 0.343 0.086 0.932 -0.643 0.701

ar.L1 0.9996 0.005 213.302 0.000 0.990 1.009

sigma2 1.4355 0.143 10.008 0.000 1.154 1.717

===================================================================================

Ljung-Box (L1) (Q): 48.05 Jarque-Bera (JB): 20.69

Prob(Q): 0.00 Prob(JB): 0.00

Heteroskedasticity (H): 19.26 Skew: 0.90

Prob(H) (two-sided): 0.00 Kurtosis: 3.86

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

/Users/kristian/miniforge3/envs/ind320_25/lib/python3.12/site-packages/statsmodels/tsa/statespace/sarimax.py:966: UserWarning: Non-stationary starting autoregressive parameters found. Using zeros as starting parameters.

warn('Non-stationary starting autoregressive parameters'

MA - moving average models#

MA models are functions of previous errors, rather than previous measurements.

We can define an \(MA(q)\) model as:

Here, \(q\) is the number of time lags and \(\Phi(L)^{q}\) is defined as \(\Theta\) above, but using the error terms and \(\epsilon_{t}\) is with respect to the current model.

# Fit an MA(1) model (disregarding the obvious autocorrelation)

mod = sm.tsa.statespace.SARIMAX(data['wpi'], trend='c', order=(0,0,1))

res = mod.fit(disp=False)

print(res.summary()) # AIC gives us a measure of fit for comparison

SARIMAX Results

==============================================================================

Dep. Variable: wpi No. Observations: 124

Model: SARIMAX(0, 0, 1) Log Likelihood -516.522

Date: Mon, 24 Nov 2025 AIC 1039.044

Time: 09:18:46 BIC 1047.505

Sample: 01-01-1960 HQIC 1042.481

- 10-01-1990

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

intercept 62.8671 3.033 20.727 0.000 56.922 68.812

ma.L1 0.9994 0.578 1.728 0.084 -0.134 2.133

sigma2 233.8562 132.640 1.763 0.078 -26.114 493.827

===================================================================================

Ljung-Box (L1) (Q): 114.21 Jarque-Bera (JB): 14.05

Prob(Q): 0.00 Prob(JB): 0.00

Heteroskedasticity (H): 1.55 Skew: 0.31

Prob(H) (two-sided): 0.17 Kurtosis: 1.47

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

/Users/kristian/miniforge3/envs/ind320_25/lib/python3.12/site-packages/statsmodels/tsa/statespace/sarimax.py:978: UserWarning: Non-invertible starting MA parameters found. Using zeros as starting parameters.

warn('Non-invertible starting MA parameters found.'

ARMA - autoregressive moving average models#

When we take the sum of \(AR(p)\) and \(MA(q)\) models of the same time series, we get \(ARMA(p,q)\) models:

which can be reformulated to:

Again, \(\epsilon_{t}\) is with respect to the current model, but shares name with the previous models.

This model is learning both from seeing previous samples and from how well these were predicted at previous time steps, thus it can tackle changes in the average.

# Fit an ARMA(1,1) model (badly specified due to non-stationarity)

mod = sm.tsa.statespace.SARIMAX(data['wpi'], trend='c', order=(1,0,1))

res = mod.fit(disp=False)

print(res.summary()) # AIC gives us a measure of fit for comparison

SARIMAX Results

==============================================================================

Dep. Variable: wpi No. Observations: 124

Model: SARIMAX(1, 0, 1) Log Likelihood -172.610

Date: Mon, 24 Nov 2025 AIC 353.221

Time: 09:18:46 BIC 364.502

Sample: 01-01-1960 HQIC 357.804

- 10-01-1990

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

intercept 0.0438 0.427 0.103 0.918 -0.794 0.882

ar.L1 0.9994 0.006 172.091 0.000 0.988 1.011

ma.L1 0.5628 0.072 7.848 0.000 0.422 0.703

sigma2 0.8883 0.079 11.303 0.000 0.734 1.042

===================================================================================

Ljung-Box (L1) (Q): 0.80 Jarque-Bera (JB): 60.64

Prob(Q): 0.37 Prob(JB): 0.00

Heteroskedasticity (H): 15.38 Skew: 1.17

Prob(H) (two-sided): 0.00 Kurtosis: 5.51

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

/Users/kristian/miniforge3/envs/ind320_25/lib/python3.12/site-packages/statsmodels/tsa/statespace/sarimax.py:966: UserWarning: Non-stationary starting autoregressive parameters found. Using zeros as starting parameters.

warn('Non-stationary starting autoregressive parameters'

ARIMA - autoregressive integrated moving average models#

To help compensate for lack of stationarity, we add an integration operator, \(\Delta^{d}\), defined as:

Here, \(y_{t}^{[0]} = y_{t}\) and the degree of differensing is \(d\).

For instance with \(d=2\):

An \(ARMA(p, q)\) model where \(y_{t}\) is exchanged with \(y_{t}^{[d]}\) would look like this:

The constant is often omitted and assumed absorbed by the integration. Only the time series is integrated, not the errors.

Reformulating this using the integration operator, we get an \(ARIMA(p,d,q)\) model:

This model has the properties of the ARMA model, but in addition does the differensing for us for stationarity.

The terms can be reorganised to get predictions on the original scale instead of predicting difference values.

# Fit an ARIMA(1,1,1) model

mod = sm.tsa.statespace.SARIMAX(data['wpi'], trend=None, order=(1,1,1))

res = mod.fit(disp=False)

print(res.summary()) # AIC gives us a measure of fit for comparison

SARIMAX Results

==============================================================================

Dep. Variable: wpi No. Observations: 124

Model: SARIMAX(1, 1, 1) Log Likelihood -137.247

Date: Mon, 24 Nov 2025 AIC 280.494

Time: 09:18:46 BIC 288.930

Sample: 01-01-1960 HQIC 283.920

- 10-01-1990

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 0.9412 0.030 31.695 0.000 0.883 0.999

ma.L1 -0.4656 0.088 -5.314 0.000 -0.637 -0.294

sigma2 0.5398 0.054 10.071 0.000 0.435 0.645

===================================================================================

Ljung-Box (L1) (Q): 0.05 Jarque-Bera (JB): 9.12

Prob(Q): 0.82 Prob(JB): 0.01

Heteroskedasticity (H): 28.75 Skew: 0.07

Prob(H) (two-sided): 0.00 Kurtosis: 4.33

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

#### Fit an ARIMA(1,1,1) model

mod = sm.tsa.statespace.SARIMAX(data['wpi'], trend=None, order=(1,1,1))

res = mod.fit(disp=False)

print(res.summary()) # AIC gives us a measure of fit for comparison

SARIMAX Results

==============================================================================

Dep. Variable: wpi No. Observations: 124

Model: SARIMAX(1, 1, 1) Log Likelihood -137.247

Date: Mon, 24 Nov 2025 AIC 280.494

Time: 09:18:46 BIC 288.930

Sample: 01-01-1960 HQIC 283.920

- 10-01-1990

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 0.9412 0.030 31.695 0.000 0.883 0.999

ma.L1 -0.4656 0.088 -5.314 0.000 -0.637 -0.294

sigma2 0.5398 0.054 10.071 0.000 0.435 0.645

===================================================================================

Ljung-Box (L1) (Q): 0.05 Jarque-Bera (JB): 9.12

Prob(Q): 0.82 Prob(JB): 0.01

Heteroskedasticity (H): 28.75 Skew: 0.07

Prob(H) (two-sided): 0.00 Kurtosis: 4.33

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

# Since the data are quarterly, we can add a seasonal component by including a fourth time lag to moving average

# Fit an ARIMA(1,1,[1,0,0,1]) model

mod = sm.tsa.statespace.SARIMAX(data['wpi'], trend=None, order=(1,1,[1,0,0,1]))

res = mod.fit(disp=False)

print(res.summary()) # AIC gives us a measure of fit for comparison

# What about a linear trend? (trend='t')

SARIMAX Results

=================================================================================

Dep. Variable: wpi No. Observations: 124

Model: SARIMAX(1, 1, [1, 4]) Log Likelihood -137.202

Date: Mon, 24 Nov 2025 AIC 282.404

Time: 09:18:46 BIC 293.653

Sample: 01-01-1960 HQIC 286.973

- 10-01-1990

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 0.9313 0.041 22.884 0.000 0.852 1.011

ma.L1 -0.4540 0.093 -4.884 0.000 -0.636 -0.272

ma.L4 0.0433 0.082 0.526 0.599 -0.118 0.205

sigma2 0.5394 0.054 9.953 0.000 0.433 0.646

===================================================================================

Ljung-Box (L1) (Q): 0.04 Jarque-Bera (JB): 10.31

Prob(Q): 0.84 Prob(JB): 0.01

Heteroskedasticity (H): 29.04 Skew: 0.06

Prob(H) (two-sided): 0.00 Kurtosis: 4.41

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

SARIMA - seasonal autoregressive integrated moving average models#

SARIMA shares some resemblance with the STL decomposition introduced previously.

For seasons of length \(s\), the seasonal part is obtained by applying an ARIMA model with lags, \(P\) and \(Q\), and integration time, \(D\), that are multiples of \(s\), i.e., if \(P=2\), the included time points would be \(t-1s\) and \(t-2s\).

After the seasonal part has been removed, another \(ARIMA(p, d, q)\) is applied to \(\Delta_{s}^{D} y_{t}\) which is equivalent to multiplying the two models together.

The \(SARIMA(p, d, q)(P, D, Q, s)\) model then becomes:

This model has the ability to combine experience from previous timepoints with seasonal trends.

Or if one sets the ARIMA parameters \(p=0\), \(d=0\), \(q=0\), one can have a pure seasonal model.

# Using SARIMA for seasonality instead of the fourth time lag to moving average.

# Fit a SARIMA(1,1,1)(1,1,1,4) model

mod = sm.tsa.statespace.SARIMAX(data['wpi'], trend=None, order=(1,1,1), seasonal_order=(1,1,1,4))

res = mod.fit(disp=False)

print(res.summary()) # AIC gives us a measure of fit for comparison (no improvement here)

SARIMAX Results

=========================================================================================

Dep. Variable: wpi No. Observations: 124

Model: SARIMAX(1, 1, 1)x(1, 1, 1, 4) Log Likelihood -135.889

Date: Mon, 24 Nov 2025 AIC 281.778

Time: 09:18:47 BIC 295.674

Sample: 01-01-1960 HQIC 287.421

- 10-01-1990

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 0.8767 0.060 14.588 0.000 0.759 0.994

ma.L1 -0.3819 0.111 -3.453 0.001 -0.599 -0.165

ar.S.L4 0.0592 0.112 0.528 0.598 -0.161 0.279

ma.S.L4 -0.9990 4.690 -0.213 0.831 -10.191 8.193

sigma2 0.5180 2.404 0.215 0.829 -4.194 5.229

===================================================================================

Ljung-Box (L1) (Q): 0.07 Jarque-Bera (JB): 20.16

Prob(Q): 0.80 Prob(JB): 0.00

Heteroskedasticity (H): 29.33 Skew: -0.17

Prob(H) (two-sided): 0.00 Kurtosis: 4.99

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

Exogenous variables#

As we showed in the previous chapter, it is possible to make a model purely on other variables measured at the same time, \(t\).

Including these variables into ARIMA and SARIMA, we get the ARIMAX and SARIMAX models.

In practice, we paste on an extra coefficient vector, \(\beta\), and variables, \(X_{t}\), to the models, here noted as sums of products \(\beta_{i} x^{i}_{t}\):

\(ARIMAX(p, d, q)\):

\(SARIMAX(p, d, q)(P, D, Q, s)\):

The final model, thus includes autogression and moving averages, can perform differences, deals with seasonality and can leverage external variables from the same timepoint as the predictions.

# Read the FinalData sheet of the OilExchange.xlsx file using Pandas again

import pandas as pd

OilExchange = pd.read_excel('../../data/OilExchange.xlsx', sheet_name='FinalData')

OilExchange.index = OilExchange.Date

OilExchange.index.freq = "MS" # Set the frequency to Month Start

OilExchange.head()

/Users/kristian/miniforge3/envs/ind320_25/lib/python3.12/site-packages/openpyxl/worksheet/_reader.py:329: UserWarning: Unknown extension is not supported and will be removed

warn(msg)

| Date | PerEURO | PerUSD | KeyIntRate | LoanIntRate | EuroIntRate | CPI | OilSpotPrice | ImpOldShip | ImpNewShip | ... | ExpExShipOilPlat | TrBal | TrBalExShipOilPlat | TrBalMland | ly.var | l2y.var | l.CPI | ExcChange | Testrain | season | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||||||||||||

| 2000-01-01 | 2000-01-01 | 8.1215 | 8.0129 | 5.500000 | 7.500000 | 3.04 | 104.1 | 25.855741 | 114 | 915 | ... | 38619 | 18575 | 19238 | -3257 | 8.0968 | 8.1907 | 103.6 | Increase | True | winter |

| 2000-02-01 | 2000-02-01 | 8.0991 | 8.2361 | 5.500000 | 7.500000 | 3.28 | 104.6 | 27.317905 | 527 | 359 | ... | 38730 | 14217 | 17200 | -4529 | 8.1215 | 8.0968 | 104.1 | Decrease | True | winter |

| 2000-03-01 | 2000-03-01 | 8.1110 | 8.4111 | 5.500000 | 7.500000 | 3.51 | 104.7 | 26.509183 | 1385 | 929 | ... | 42642 | 13697 | 18380 | -5562 | 8.0991 | 8.1215 | 104.6 | Increase | True | Spring |

| 2000-04-01 | 2000-04-01 | 8.1538 | 8.6081 | 5.632353 | 7.632353 | 3.69 | 105.1 | 21.558821 | 450 | 2194 | ... | 36860 | 13142 | 15499 | -5147 | 8.1110 | 8.0991 | 104.7 | Increase | True | Spring |

| 2000-05-01 | 2000-05-01 | 8.2015 | 9.0471 | 5.750000 | 7.750000 | 3.92 | 105.1 | 25.147242 | 239 | 608 | ... | 42932 | 17733 | 18505 | -5732 | 8.1538 | 8.1110 | 105.1 | Increase | True | Spring |

5 rows × 28 columns

# Fit a SARIMAX(1,1,1)(1,1,1,12) model with exogenous variables (closing our eyes, as we know little about the data)

mod = sm.tsa.statespace.SARIMAX(OilExchange['PerEURO'], exog=OilExchange.loc[:, OilExchange.columns[3:-6]], \

trend='c', order=(1,1,1), seasonal_order=(1,1,1,12))

res = mod.fit(disp=False)

print(res.summary()) # AIC gives us a measure of fit for comparison (no improvement here)

SARIMAX Results

==========================================================================================

Dep. Variable: PerEURO No. Observations: 179

Model: SARIMAX(1, 1, 1)x(1, 1, 1, 12) Log Likelihood 103.848

Date: Mon, 24 Nov 2025 AIC -157.695

Time: 09:18:48 BIC -79.896

Sample: 01-01-2000 HQIC -126.116

- 11-01-2014

Covariance Type: opg

======================================================================================

coef std err z P>|z| [0.025 0.975]

--------------------------------------------------------------------------------------

intercept 0.0011 0.018 0.061 0.951 -0.034 0.037

KeyIntRate -0.2262 0.279 -0.810 0.418 -0.773 0.321

LoanIntRate -0.0130 0.254 -0.051 0.959 -0.511 0.485

EuroIntRate 0.2143 0.107 2.009 0.045 0.005 0.423

CPI -0.0051 0.028 -0.180 0.857 -0.061 0.050

OilSpotPrice -0.0043 0.001 -3.124 0.002 -0.007 -0.002

ImpOldShip -0.0144 0.021 -0.684 0.494 -0.056 0.027

ImpNewShip -0.0144 0.021 -0.685 0.493 -0.056 0.027

ImpOilPlat -0.0144 0.021 -0.686 0.493 -0.056 0.027

ImpExShipOilPlat -0.0005 0.023 -0.021 0.983 -0.045 0.044

ExpCrdOil -0.0026 0.015 -0.172 0.863 -0.032 0.027

ExpNatGas -0.0026 0.015 -0.171 0.864 -0.032 0.027

ExpCond -0.0026 0.015 -0.172 0.864 -0.032 0.027

ExpOldShip 0.0144 0.021 0.684 0.494 -0.027 0.056

ExpNewShip 0.0144 0.021 0.685 0.493 -0.027 0.056

ExpOilPlat 0.0144 0.021 0.686 0.492 -0.027 0.056

ExpExShipOilPlat 0.0005 0.023 0.021 0.983 -0.044 0.045

TrBal -0.0144 0.021 -0.685 0.493 -0.056 0.027

TrBalExShipOilPlat 0.0165 0.019 0.852 0.394 -0.022 0.055

TrBalMland -0.0026 0.015 -0.172 0.863 -0.032 0.027

ar.L1 -0.7115 0.275 -2.587 0.010 -1.251 -0.172

ma.L1 0.8770 0.186 4.716 0.000 0.513 1.241

ar.S.L12 -0.2670 0.218 -1.223 0.221 -0.695 0.161

ma.S.L12 -0.4389 0.228 -1.926 0.054 -0.885 0.008

sigma2 0.0225 0.004 5.584 0.000 0.015 0.030

===================================================================================

Ljung-Box (L1) (Q): 0.59 Jarque-Bera (JB): 1.54

Prob(Q): 0.44 Prob(JB): 0.46

Heteroskedasticity (H): 0.91 Skew: 0.11

Prob(H) (two-sided): 0.72 Kurtosis: 3.41

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).

/Users/kristian/miniforge3/envs/ind320_25/lib/python3.12/site-packages/statsmodels/base/model.py:607: ConvergenceWarning: Maximum Likelihood optimization failed to converge. Check mle_retvals

warnings.warn("Maximum Likelihood optimization failed to "

Exercise#

Play with the OilExchange data.

See if you can improve the fit of the model by adjusting lags and removing the least significant terms in the model.

Interpretation of Model Diagnostic Tests#

Ljung-Box (L1) (Q)#

Purpose: Tests for autocorrelation in the residuals.

Null hypothesis (H₀): The residuals are independently distributed (no autocorrelation up to lag L1).

Result:

Q: test statistic

Prob(Q): >0.05 is good

Jarque-Bera (JB)#

Purpose: Tests whether the residuals are normally distributed (based on skewness and kurtosis).

Null hypothesis (H₀): The residuals are normally distributed.

Result:

JB: test statistic

Prob(JB): >0.05 is good

Heteroskedasticity (H)#

Purpose: Tests whether the residuals have constant variance (homoskedasticity).

Null hypothesis (H₀): The residuals have constant variance.

Result:

H: test statistic

Prob(H): >0.05 is good

Skew and Kurtosis#

Skew: Measures asymmetry of the residuals. 0 means symmetric; positive means right-skewed.

Kurtosis: Measures “tailedness” of the residuals. 3 is normal; higher means heavier tails.

In practice:

Independence and constant variance are more important for forecasting than perfect normality.

Non-normality is common in real-world time series models.

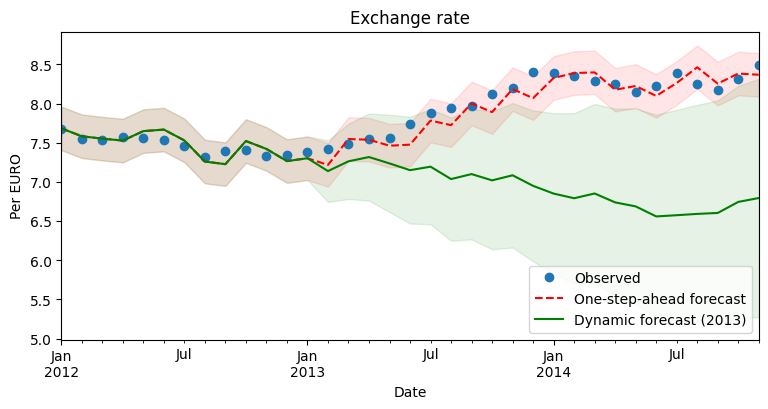

SARIMAX prediction#

One-step-ahead prediction uses the estimated parameters and samples within the lags of the model to predict the next time point.

This means that the predictions will stay relatively close to the true values, never predicting more than one step away from the truth.

Dynamic prediction predicts one step as above, then uses predicted values as input instead of true values.

This means the predictions can deviate from the truth over time.

# Refit the model on the training set (up to 2013-01-01) to estimate the parameters

mod = sm.tsa.statespace.SARIMAX(OilExchange['PerEURO'].loc[:'2013-01-01'], \

OilExchange.loc[:, OilExchange.columns[3:-4]].loc[:'2013-01-01'], \

trend='c', order=(1,1,1), seasonal_order=(1,1,1,12))

res = mod.fit(disp=False)

/Users/kristian/miniforge3/envs/ind320_25/lib/python3.12/site-packages/statsmodels/tsa/statespace/sarimax.py:966: UserWarning: Non-stationary starting autoregressive parameters found. Using zeros as starting parameters.

warn('Non-stationary starting autoregressive parameters'

/Users/kristian/miniforge3/envs/ind320_25/lib/python3.12/site-packages/statsmodels/tsa/statespace/sarimax.py:978: UserWarning: Non-invertible starting MA parameters found. Using zeros as starting parameters.

warn('Non-invertible starting MA parameters found.'

/Users/kristian/miniforge3/envs/ind320_25/lib/python3.12/site-packages/statsmodels/base/model.py:607: ConvergenceWarning: Maximum Likelihood optimization failed to converge. Check mle_retvals

warnings.warn("Maximum Likelihood optimization failed to "

# Get predictions for the whole dataset

mod = sm.tsa.statespace.SARIMAX(OilExchange['PerEURO'], OilExchange.loc[:, OilExchange.columns[3:-4]], \

trend='c', order=(1,1,1), seasonal_order=(1,1,1,12))

res = mod.filter(res.params) # One-step-ahead predictions using parameters from previous fit

# In-sample one-step-ahead prediction wrapper function

predict = res.get_prediction()

predict_ci = predict.conf_int()

# Dynamic predictions starting from 2013-01-01

predict_dy = res.get_prediction(dynamic='2013-01-01')

predict_dy_ci = predict_dy.conf_int()

# Compare the one-step-ahead predictions to the dynamic predictions

fig, ax = plt.subplots(figsize=(9,4))

npre = 4

ax.set(title='Exchange rate', xlabel='Date', ylabel='Per EURO')

# Plot data points

OilExchange.loc['2012-01-01':, 'PerEURO'].plot(ax=ax, style='o', label='Observed')

# Plot predictions

predict.predicted_mean.loc['2012-01-01':].plot(ax=ax, style='r--', label='One-step-ahead forecast')

ci = predict_ci.loc['2012-01-01':]

ax.fill_between(ci.index, ci.iloc[:,0], ci.iloc[:,1], color='r', alpha=0.1)

predict_dy.predicted_mean.loc['2012-01-01':].plot(ax=ax, style='g', label='Dynamic forecast (2013)')

ci = predict_dy_ci.loc['2012-01-01':]

ax.fill_between(ci.index, ci.iloc[:,0], ci.iloc[:,1], color='g', alpha=0.1)

legend = ax.legend(loc='lower right')

Questercise#

Does the model made in the previous exercise improve the predictions as visualized above?