Machine Learning approach#

Time series prediction, or forecasting, can be very similar to modelling and prediction with tabular data.

A set of input variables, usually a single output variable.

Ordinary machine learning methods can be applied.

The inclusion of time can be done by adding one or more delayed variables, possibly including the response.

Validation#

As soon as time is part of a model, extra care needs to be taken in validation.

Cross-validation*, training-validation-test splits are still relevant.

However, training, validation and test sets need to follow time chronologically and cannot overlap.

Instead of traditional cross-validation, one can perform backtesting with a sliding or expanding window:

Figures from Roy Yang’s bloggpost on uber.com

Note

The first samples will never be in the test set!

Shipping, oil, interest rates and exchange rates#

These data are public data from the Norwegian Bank, SSB, Eurostat and U.S. Energy Information Administration for the period 2000-2014 (monthly).

The data are available at ResearchGate and were part of a Master thesis by Raju Rimal.

# Read the FinalData sheet of the OilExchange.xlsx file using Pandas

import pandas as pd

# You may get a warning here, because the file contains pasted grahics

OilExchange = pd.read_excel('../../data/OilExchange.xlsx', sheet_name='FinalData')

OilExchange.head()

/Users/kristian/miniforge3/envs/ind320_25/lib/python3.12/site-packages/openpyxl/worksheet/_reader.py:329: UserWarning: Unknown extension is not supported and will be removed

warn(msg)

| Date | PerEURO | PerUSD | KeyIntRate | LoanIntRate | EuroIntRate | CPI | OilSpotPrice | ImpOldShip | ImpNewShip | ... | ExpExShipOilPlat | TrBal | TrBalExShipOilPlat | TrBalMland | ly.var | l2y.var | l.CPI | ExcChange | Testrain | season | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2000-01-01 | 8.1215 | 8.0129 | 5.500000 | 7.500000 | 3.04 | 104.1 | 25.855741 | 114 | 915 | ... | 38619 | 18575 | 19238 | -3257 | 8.0968 | 8.1907 | 103.6 | Increase | True | winter |

| 1 | 2000-02-01 | 8.0991 | 8.2361 | 5.500000 | 7.500000 | 3.28 | 104.6 | 27.317905 | 527 | 359 | ... | 38730 | 14217 | 17200 | -4529 | 8.1215 | 8.0968 | 104.1 | Decrease | True | winter |

| 2 | 2000-03-01 | 8.1110 | 8.4111 | 5.500000 | 7.500000 | 3.51 | 104.7 | 26.509183 | 1385 | 929 | ... | 42642 | 13697 | 18380 | -5562 | 8.0991 | 8.1215 | 104.6 | Increase | True | Spring |

| 3 | 2000-04-01 | 8.1538 | 8.6081 | 5.632353 | 7.632353 | 3.69 | 105.1 | 21.558821 | 450 | 2194 | ... | 36860 | 13142 | 15499 | -5147 | 8.1110 | 8.0991 | 104.7 | Increase | True | Spring |

| 4 | 2000-05-01 | 8.2015 | 9.0471 | 5.750000 | 7.750000 | 3.92 | 105.1 | 25.147242 | 239 | 608 | ... | 42932 | 17733 | 18505 | -5732 | 8.1538 | 8.1110 | 105.1 | Increase | True | Spring |

5 rows × 28 columns

OilExchange.columns

Index(['Date', 'PerEURO', 'PerUSD', 'KeyIntRate', 'LoanIntRate', 'EuroIntRate',

'CPI', 'OilSpotPrice', 'ImpOldShip', 'ImpNewShip', 'ImpOilPlat',

'ImpExShipOilPlat', 'ExpCrdOil', 'ExpNatGas', 'ExpCond', 'ExpOldShip',

'ExpNewShip', 'ExpOilPlat', 'ExpExShipOilPlat', 'TrBal',

'TrBalExShipOilPlat', 'TrBalMland', 'ly.var', 'l2y.var', 'l.CPI',

'ExcChange', 'Testrain', 'season'],

dtype='object')

# Read the FinalCodeBook sheet of the OilExchange.xlsx file using Pandas

Explanations = pd.read_excel('../../data/OilExchange.xlsx', sheet_name='FinalCodeBook')

Explanations[['Variables','Label']]

/Users/kristian/miniforge3/envs/ind320_25/lib/python3.12/site-packages/openpyxl/worksheet/_reader.py:329: UserWarning: Unknown extension is not supported and will be removed

warn(msg)

| Variables | Label | |

|---|---|---|

| 0 | Date | Date |

| 1 | PerEURO | Exchange Rate of NOK per Euro |

| 2 | PerUSD | Exchange Rate of NOK per USD |

| 3 | KeyIntRate | Key policy rate (Percent) |

| 4 | LoanIntRate | Overnight Lending Rate (Nominal) |

| 5 | EuroIntRate | Money market interest rates of Euro area (EA11... |

| 6 | CPI | Consumer Price Index (1998=100) |

| 7 | OilSpotPrice | Europe Brent Spot Price FOB (NOK per Barrel) |

| 8 | ImpOldShip | Imports of elderly ships (NOK million) |

| 9 | ImpNewShip | Imports of new ships (NOK million) |

| 10 | ImpOilPlat | Imports of oil platforms (NOK million) |

| 11 | ImpExShipOilPlat | Imports excl. ships and oil platforms (NOK mil... |

| 12 | ExpCrdOil | Exports of crude oil (NOK million) |

| 13 | ExpNatGas | Exports of natural gas (NOK million) |

| 14 | ExpCond | Exports of condensates (NOK million) |

| 15 | ExpOldShip | Exports of elderly ships (NOK million) |

| 16 | ExpNewShip | Exports of new ships (NOK million) |

| 17 | ExpOilPlat | Exports of oil platforms (NOK million) |

| 18 | ExpExShipOilPlat | Exports excl. ships and oil platforms (NOK mil... |

| 19 | TrBal | Trade balance (Total exports - total imports) ... |

| 20 | TrBalExShipOilPlat | Trade balance (Exports - imports, both excl. s... |

| 21 | TrBalMland | Trade balance (Mainland exports - imports excl... |

| 22 | ly.var | First Lag Exchange Rate of NOK per Euro |

| 23 | l2y.var | Second Lag Exchange Rate of NOK per Euro |

| 24 | l.CPI | First Lag of Consumer Price Index |

| 25 | ExcChange | Change status of Exchange Rate (Increase, Decr... |

| 26 | Testrain | Test and Train seperation of data |

| 27 | season | Seasons |

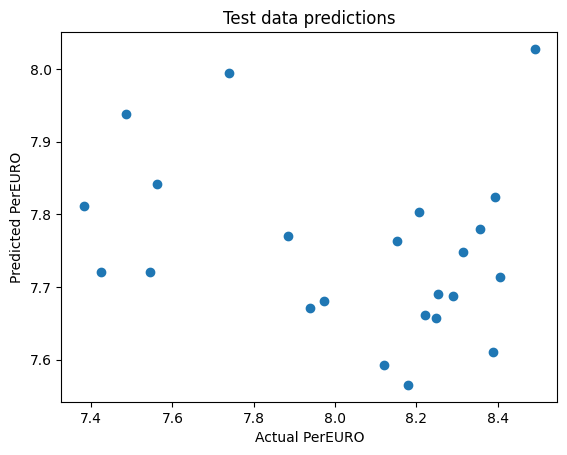

Modelling without time#

For starters, let us ignore time and build a simple prediction model for the exchange rate.

We will use scikit-learn’s Pipeline to combine standardisation (scaling) and linear regression and cross_val_predict to perform random K-fold cross-validation.

# Import Pipeline, StandardScaler, and LinearRegression from their respective modules in sklearn

from sklearn.pipeline import Pipeline

from sklearn.preprocessing import StandardScaler

from sklearn.linear_model import LinearRegression

# Create a pipeline that scales the data and performs linear regression

pipe = Pipeline([('scaler', StandardScaler()), ('reg', LinearRegression())])

# Fit the pipeline with PerEURO as response and variables 3:-6 as predictors for the samples having True in the Testrain column

OilExchange_train = OilExchange.loc[OilExchange.Testrain==True,:].copy()

OilExchange_test = OilExchange.loc[OilExchange.Testrain==False,:].copy()

pipe.fit(OilExchange_train.loc[:, OilExchange_train.columns[3:-6]], \

OilExchange_train.loc[:, 'PerEURO'])

Pipeline(steps=[('scaler', StandardScaler()), ('reg', LinearRegression())])In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

Parameters

| steps | [('scaler', ...), ('reg', ...)] | |

| transform_input | None | |

| memory | None | |

| verbose | False |

Parameters

| copy | True | |

| with_mean | True | |

| with_std | True |

Parameters

| fit_intercept | True | |

| copy_X | True | |

| tol | 1e-06 | |

| n_jobs | None | |

| positive | False |

# Predict the corresponding data for Testrain = False

PerEURO_pred = pipe.predict(OilExchange_test.loc[:, OilExchange.columns[3:-6]])

# Plot the predicted values against the actual values

import matplotlib.pyplot as plt

plt.scatter(OilExchange_test.loc[:, 'PerEURO'], PerEURO_pred)

plt.xlabel('Actual PerEURO')

plt.ylabel('Predicted PerEURO')

plt.title('Test data predictions')

plt.show()

# R2 for the test data

from sklearn.metrics import r2_score

r2_score(OilExchange_test.loc[:, 'PerEURO'], PerEURO_pred)

-0.979009519262404

# Perform k-fold cross-validation with k=10

from sklearn.model_selection import cross_val_predict # NOTE: Not for time series!

PerEURO_cv = cross_val_predict(pipe, OilExchange_train.loc[:, OilExchange.columns[3:-6]], \

OilExchange_train.loc[:, 'PerEURO'], cv=10)

# Compute R^2 for PerEURO_cv

r2_cv = r2_score(OilExchange_train.loc[:, 'PerEURO'], PerEURO_cv)

print("Cross-validated R2: {:.3f}".format(r2_cv))

Cross-validated R2: -0.317

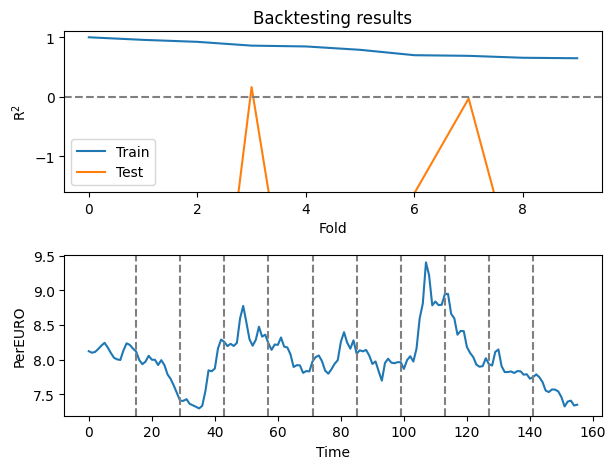

Backtesting#

scikit-learn has a TimeSeriesSplit which creates segments for backtesting.

Expanding window is the default.

Sliding window can be applied by setting the right combination of parameters.

We will use scikit-learn’s cross_validate to perform the cross-validation based on the backtesting segments (cross_val_predict assumes that all observations will be test data at some point).

# Backtesting using scikit-learn

import numpy as np

from sklearn.model_selection import TimeSeriesSplit

# Some data

X = np.array([[1, 2], [3, 4], [1, 2], [3, 4], [1, 2], [3, 4]])

y = np.array([1, 2, 3, 4, 5, 6])

# Create time series cross-validation object with expanding window

tscv_expand = TimeSeriesSplit()

print(tscv_expand)

for i, (train_index, test_index) in enumerate(tscv_expand.split(X)):

print(f"Fold {i}:")

print(f" Train: index={train_index}")

print(f" Test: index={test_index}")

TimeSeriesSplit(gap=0, max_train_size=None, n_splits=5, test_size=None)

Fold 0:

Train: index=[0]

Test: index=[1]

Fold 1:

Train: index=[0 1]

Test: index=[2]

Fold 2:

Train: index=[0 1 2]

Test: index=[3]

Fold 3:

Train: index=[0 1 2 3]

Test: index=[4]

Fold 4:

Train: index=[0 1 2 3 4]

Test: index=[5]

# Backtesting with sliding window

tscv_slide = TimeSeriesSplit(max_train_size=3, n_splits=3)

print(tscv_slide)

for i, (train_index, test_index) in enumerate(tscv_slide.split(X)):

print(f"Fold {i}:")

print(f" Train: index={train_index}")

print(f" Test: index={test_index}")

TimeSeriesSplit(gap=0, max_train_size=3, n_splits=3, test_size=None)

Fold 0:

Train: index=[0 1 2]

Test: index=[3]

Fold 1:

Train: index=[1 2 3]

Test: index=[4]

Fold 2:

Train: index=[2 3 4]

Test: index=[5]

# Backtesting with expanding window in the OilExchange data

tscv_expand = TimeSeriesSplit(n_splits=10)

# The segments

max_train = []

for i, (train_index, test_index) in enumerate(tscv_expand.split(OilExchange_train.loc[:, 'PerEURO'])):

print(f"Fold {i}:")

print(f" Train: index={train_index}")

max_train.append(max(train_index))

print(f" Test: index={test_index}")

Fold 0:

Train: index=[ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15]

Test: index=[16 17 18 19 20 21 22 23 24 25 26 27 28 29]

Fold 1:

Train: index=[ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

24 25 26 27 28 29]

Test: index=[30 31 32 33 34 35 36 37 38 39 40 41 42 43]

Fold 2:

Train: index=[ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43]

Test: index=[44 45 46 47 48 49 50 51 52 53 54 55 56 57]

Fold 3:

Train: index=[ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47

48 49 50 51 52 53 54 55 56 57]

Test: index=[58 59 60 61 62 63 64 65 66 67 68 69 70 71]

Fold 4:

Train: index=[ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47

48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71]

Test: index=[72 73 74 75 76 77 78 79 80 81 82 83 84 85]

Fold 5:

Train: index=[ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47

48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71

72 73 74 75 76 77 78 79 80 81 82 83 84 85]

Test: index=[86 87 88 89 90 91 92 93 94 95 96 97 98 99]

Fold 6:

Train: index=[ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47

48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71

72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95

96 97 98 99]

Test: index=[100 101 102 103 104 105 106 107 108 109 110 111 112 113]

Fold 7:

Train: index=[ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35

36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53

54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71

72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89

90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107

108 109 110 111 112 113]

Test: index=[114 115 116 117 118 119 120 121 122 123 124 125 126 127]

Fold 8:

Train: index=[ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35

36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53

54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71

72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89

90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107

108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125

126 127]

Test: index=[128 129 130 131 132 133 134 135 136 137 138 139 140 141]

Fold 9:

Train: index=[ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35

36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53

54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71

72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89

90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107

108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125

126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141]

Test: index=[142 143 144 145 146 147 148 149 150 151 152 153 154 155]

# Backtesting using expanding window with data

from sklearn.model_selection import cross_validate

scores = cross_validate(pipe, OilExchange_train.loc[:, OilExchange_train.columns[3:-6]], \

OilExchange_train.loc[:, 'PerEURO'], cv=tscv_expand, \

scoring='r2', return_train_score=True)

scores

{'fit_time': array([0.00148821, 0.00127006, 0.00117683, 0.00132012, 0.00141788,

0.0011673 , 0.00135612, 0.00112104, 0.00110602, 0.00110292]),

'score_time': array([0.00065684, 0.00057912, 0.0005548 , 0.00059104, 0.00058508,

0.00055075, 0.00057864, 0.00054073, 0.00054502, 0.00053692]),

'test_score': array([-2.58120320e+03, -4.60283547e+00, -7.14984703e+00, 1.63052775e-01,

-5.45069739e+00, -1.00734416e+11, -1.62104880e+00, -2.82911176e-02,

-3.42287951e+00, -1.33079128e+01]),

'train_score': array([1. , 0.95679732, 0.92352087, 0.85969706, 0.84590771,

0.78920227, 0.69881999, 0.68809706, 0.65576638, 0.64771763])}

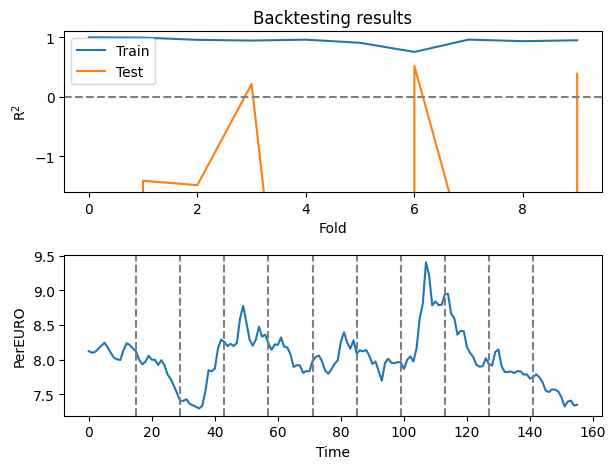

# Plot the backtesting results for train and test data, and under it ad the original data (PerEURO) as a subplot

plt.subplot(2,1,1)

plt.plot(scores['train_score'], label='Train')

plt.plot(scores['test_score'], label='Test')

plt.xlabel('Fold')

plt.ylabel('R$^2$')

plt.title('Backtesting results')

plt.axhline(0, color='gray', linestyle='--')

plt.ylim(-1.6,1.1)

plt.legend()

plt.subplot(2,1,2)

plt.plot(OilExchange_train.loc[:, 'PerEURO'])

for i in range(10):

plt.axvline(x=max_train[i], color='gray', linestyle='--')

plt.xlabel('Time')

plt.ylabel('PerEURO')

plt.tight_layout()

plt.show()

Question: Does the behaviour make sense with regard to what is included in and predicted from the model?

# Backtesting with sliding window in the OilExchange data

tscv_slide = TimeSeriesSplit(max_train_size=45, n_splits=10)

# The segments

max_train = []

for i, (train_index, test_index) in enumerate(tscv_slide.split(OilExchange_train.loc[:, 'PerEURO'])):

print(f"Fold {i}:")

print(f" Train: index={train_index}")

max_train.append(max(train_index))

print(f" Test: index={test_index}")

Fold 0:

Train: index=[ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15]

Test: index=[16 17 18 19 20 21 22 23 24 25 26 27 28 29]

Fold 1:

Train: index=[ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

24 25 26 27 28 29]

Test: index=[30 31 32 33 34 35 36 37 38 39 40 41 42 43]

Fold 2:

Train: index=[ 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43]

Test: index=[44 45 46 47 48 49 50 51 52 53 54 55 56 57]

Fold 3:

Train: index=[13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36

37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57]

Test: index=[58 59 60 61 62 63 64 65 66 67 68 69 70 71]

Fold 4:

Train: index=[27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50

51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71]

Test: index=[72 73 74 75 76 77 78 79 80 81 82 83 84 85]

Fold 5:

Train: index=[41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64

65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85]

Test: index=[86 87 88 89 90 91 92 93 94 95 96 97 98 99]

Fold 6:

Train: index=[55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78

79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99]

Test: index=[100 101 102 103 104 105 106 107 108 109 110 111 112 113]

Fold 7:

Train: index=[ 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86

87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104

105 106 107 108 109 110 111 112 113]

Test: index=[114 115 116 117 118 119 120 121 122 123 124 125 126 127]

Fold 8:

Train: index=[ 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100

101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118

119 120 121 122 123 124 125 126 127]

Test: index=[128 129 130 131 132 133 134 135 136 137 138 139 140 141]

Fold 9:

Train: index=[ 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114

115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132

133 134 135 136 137 138 139 140 141]

Test: index=[142 143 144 145 146 147 148 149 150 151 152 153 154 155]

# Backtesting using sliding window with data

from sklearn.model_selection import cross_validate

scores = cross_validate(pipe, OilExchange_train.loc[:, OilExchange_train.columns[3:-4]], \

OilExchange_train.loc[:, 'PerEURO'], cv=tscv_slide, \

scoring='r2', return_train_score=True)

scores

{'fit_time': array([0.00151706, 0.00126624, 0.00129414, 0.00120091, 0.00124812,

0.00124812, 0.001158 , 0.00118399, 0.00114918, 0.0011251 ]),

'score_time': array([0.00073099, 0.00058389, 0.00064683, 0.00057602, 0.00061512,

0.00056601, 0.00056005, 0.00056601, 0.00054789, 0.00055194]),

'test_score': array([-2.69048314e+03, -1.41149796e+00, -1.48578129e+00, 2.15110053e-01,

-7.83627964e+00, -1.40606556e+12, 5.20015261e-01, -2.78711930e+00,

-7.94540728e+04, 3.87646039e-01]),

'train_score': array([1. , 0.99453091, 0.95716141, 0.94470747, 0.96005874,

0.90744159, 0.75351647, 0.96129276, 0.93446863, 0.94984339])}

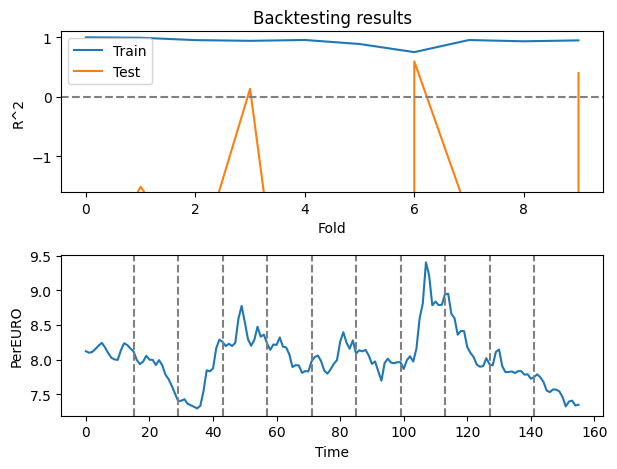

# Plot the backtesting results for train and test data, and under it ad the original data (PerEURO) as a subplot

plt.subplot(2,1,1)

plt.plot(scores['train_score'], label='Train')

plt.plot(scores['test_score'], label='Test')

plt.xlabel('Fold')

plt.ylabel('R$^2$')

plt.title('Backtesting results')

plt.axhline(0, color='gray', linestyle='--')

plt.ylim(-1.6,1.1)

plt.legend()

plt.subplot(2,1,2)

plt.plot(OilExchange_train.loc[:, 'PerEURO'])

for i in range(10):

plt.axvline(x=max_train[i], color='gray', linestyle='--')

plt.xlabel('Time')

plt.ylabel('PerEURO')

plt.tight_layout()

plt.show()

Question: Again; does the behaviour make sense with regard to what is included in and predicted from the model?

Exercise#

Repeat the PerEuro predictions, but exchange LinearRegression with scikit-learns’s PLSRegression.

Check if the number of components in the PLS model has an effect on the explained variance (\(\text{R}^2\)), either manually or using a GridSearchCV.

Including the response variable in the predictors#

As long as the training and test sets are not overlapping, we can include the response as a predictor.

Adding the response lagged can be done as a single variable or several variables (i.e., several different lags).

We will later look at ARIMA-type models where time lag is the main mechanism for modelling.

# Add the Per Euro column to the OilExchange data but shifted 1 timepoint backwards (and backfill last value)

OilExchange_train['PerEURO_lag1'] = OilExchange_train.PerEURO.shift(1).bfill()

OilExchange_train.head()

| Date | PerEURO | PerUSD | KeyIntRate | LoanIntRate | EuroIntRate | CPI | OilSpotPrice | ImpOldShip | ImpNewShip | ... | TrBal | TrBalExShipOilPlat | TrBalMland | ly.var | l2y.var | l.CPI | ExcChange | Testrain | season | PerEURO_lag1 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2000-01-01 | 8.1215 | 8.0129 | 5.500000 | 7.500000 | 3.04 | 104.1 | 25.855741 | 114 | 915 | ... | 18575 | 19238 | -3257 | 8.0968 | 8.1907 | 103.6 | Increase | True | winter | 8.1215 |

| 1 | 2000-02-01 | 8.0991 | 8.2361 | 5.500000 | 7.500000 | 3.28 | 104.6 | 27.317905 | 527 | 359 | ... | 14217 | 17200 | -4529 | 8.1215 | 8.0968 | 104.1 | Decrease | True | winter | 8.1215 |

| 2 | 2000-03-01 | 8.1110 | 8.4111 | 5.500000 | 7.500000 | 3.51 | 104.7 | 26.509183 | 1385 | 929 | ... | 13697 | 18380 | -5562 | 8.0991 | 8.1215 | 104.6 | Increase | True | Spring | 8.0991 |

| 3 | 2000-04-01 | 8.1538 | 8.6081 | 5.632353 | 7.632353 | 3.69 | 105.1 | 21.558821 | 450 | 2194 | ... | 13142 | 15499 | -5147 | 8.1110 | 8.0991 | 104.7 | Increase | True | Spring | 8.1110 |

| 4 | 2000-05-01 | 8.2015 | 9.0471 | 5.750000 | 7.750000 | 3.92 | 105.1 | 25.147242 | 239 | 608 | ... | 17733 | 18505 | -5732 | 8.1538 | 8.1110 | 105.1 | Increase | True | Spring | 8.1538 |

5 rows × 29 columns

# Backtesting using sliding window with data

from sklearn.model_selection import cross_validate # Negative indexing is scary! -->

scores = cross_validate(pipe, pd.concat([OilExchange_train.loc[:, OilExchange_train.columns[3:-7]], OilExchange_train["PerEURO_lag1"]], axis=1), \

OilExchange_train.loc[:, 'PerEURO'], cv=tscv_slide, \

scoring='r2', return_train_score=True)

scores

{'fit_time': array([0.00157189, 0.00120902, 0.00134015, 0.00125599, 0.00128293,

0.00159192, 0.00182033, 0.00150585, 0.00167918, 0.00186706]),

'score_time': array([0.0006361 , 0.00058484, 0.00057602, 0.00060701, 0.0006218 ,

0.00062799, 0.00077581, 0.00079799, 0.00065374, 0.00069189]),

'test_score': array([-3.23917569e+00, -1.51173590e+00, -2.91230071e+00, 1.34622554e-01,

-6.81986837e+00, -1.02963323e+12, 5.94148027e-01, -2.01189464e+00,

-1.67957480e+04, 3.97449531e-01]),

'train_score': array([1. , 0.9921763 , 0.95255996, 0.94041573, 0.95467944,

0.88697053, 0.75049267, 0.95403986, 0.93250471, 0.94798768])}

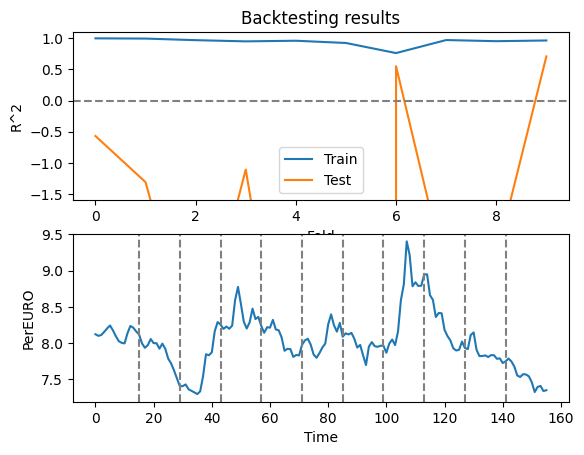

# Plot the backtesting results for train and test data, and under it ad the original data (PerEURO) as a subplot

plt.subplot(2,1,1)

plt.plot(scores['train_score'], label='Train')

plt.plot(scores['test_score'], label='Test')

plt.xlabel('Fold')

plt.ylabel('R^2')

plt.title('Backtesting results')

plt.axhline(0, color='gray', linestyle='--')

plt.ylim(-1.6,1.1)

plt.legend()

plt.subplot(2,1,2)

plt.plot(OilExchange_train.loc[:, 'PerEURO'])

for i in range(10):

plt.axvline(x=max_train[i], color='gray', linestyle='--')

plt.xlabel('Time')

plt.ylabel('PerEURO')

plt.tight_layout()

plt.show()

Five lags#

OilExchange_train['PerEURO_lag2'] = OilExchange_train.PerEURO.shift(2).bfill()

OilExchange_train['PerEURO_lag3'] = OilExchange_train.PerEURO.shift(3).bfill()

OilExchange_train['PerEURO_lag4'] = OilExchange_train.PerEURO.shift(4).bfill()

OilExchange_train['PerEURO_lag5'] = OilExchange_train.PerEURO.shift(5).bfill()

OilExchange_train.head()

| Date | PerEURO | PerUSD | KeyIntRate | LoanIntRate | EuroIntRate | CPI | OilSpotPrice | ImpOldShip | ImpNewShip | ... | l2y.var | l.CPI | ExcChange | Testrain | season | PerEURO_lag1 | PerEURO_lag2 | PerEURO_lag3 | PerEURO_lag4 | PerEURO_lag5 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2000-01-01 | 8.1215 | 8.0129 | 5.500000 | 7.500000 | 3.04 | 104.1 | 25.855741 | 114 | 915 | ... | 8.1907 | 103.6 | Increase | True | winter | 8.1215 | 8.1215 | 8.1215 | 8.1215 | 8.1215 |

| 1 | 2000-02-01 | 8.0991 | 8.2361 | 5.500000 | 7.500000 | 3.28 | 104.6 | 27.317905 | 527 | 359 | ... | 8.0968 | 104.1 | Decrease | True | winter | 8.1215 | 8.1215 | 8.1215 | 8.1215 | 8.1215 |

| 2 | 2000-03-01 | 8.1110 | 8.4111 | 5.500000 | 7.500000 | 3.51 | 104.7 | 26.509183 | 1385 | 929 | ... | 8.1215 | 104.6 | Increase | True | Spring | 8.0991 | 8.1215 | 8.1215 | 8.1215 | 8.1215 |

| 3 | 2000-04-01 | 8.1538 | 8.6081 | 5.632353 | 7.632353 | 3.69 | 105.1 | 21.558821 | 450 | 2194 | ... | 8.0991 | 104.7 | Increase | True | Spring | 8.1110 | 8.0991 | 8.1215 | 8.1215 | 8.1215 |

| 4 | 2000-05-01 | 8.2015 | 9.0471 | 5.750000 | 7.750000 | 3.92 | 105.1 | 25.147242 | 239 | 608 | ... | 8.1110 | 105.1 | Increase | True | Spring | 8.1538 | 8.1110 | 8.0991 | 8.1215 | 8.1215 |

5 rows × 33 columns

# Backtesting using sliding window with data

from sklearn.model_selection import cross_validate # Negative indexing is scary! -->

scores = cross_validate(pipe, pd.concat([OilExchange_train.loc[:, OilExchange_train.columns[3:-11]],

OilExchange_train[["PerEURO_lag1","PerEURO_lag2","PerEURO_lag3","PerEURO_lag4","PerEURO_lag5"]]], axis=1),

OilExchange_train.loc[:, 'PerEURO'], cv=tscv_slide,

scoring='r2', return_train_score=True)

scores

{'fit_time': array([0.00220704, 0.00125599, 0.00126386, 0.00159168, 0.00142789,

0.00174904, 0.00131202, 0.00124288, 0.00176287, 0.0015049 ]),

'score_time': array([0.0006609 , 0.00058627, 0.0008111 , 0.00065708, 0.00086308,

0.00062203, 0.00055814, 0.0005641 , 0.00072098, 0.00062013]),

'test_score': array([-5.69820756e-01, -1.31098583e+00, -4.22244308e+00, -1.10809063e+00,

-5.93617581e+00, -1.55149966e+12, 5.51939962e-01, -2.81878260e+00,

-2.51925736e+00, 7.09248896e-01]),

'train_score': array([1. , 0.99617589, 0.97075986, 0.95156849, 0.96162574,

0.92555208, 0.76327123, 0.97259431, 0.95439249, 0.96566249])}

# Plot the backtesting results for train and test data, and under it ad the original data (PerEURO) as a subplot

plt.subplot(2,1,1)

plt.plot(scores['train_score'], label='Train')

plt.plot(scores['test_score'], label='Test')

plt.xlabel('Fold')

plt.ylabel('R^2')

plt.title('Backtesting results')

plt.axhline(0, color='gray', linestyle='--')

plt.ylim(-1.6,1.1)

plt.legend()

plt.subplot(2,1,2)

plt.plot(OilExchange_train.loc[:, 'PerEURO'])

for i in range(10):

plt.axvline(x=max_train[i], color='gray', linestyle='--')

plt.xlabel('Time')

plt.ylabel('PerEURO')

plt.show()

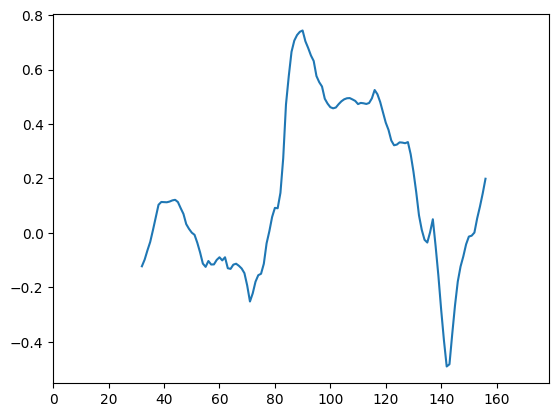

Correlation between time series#

To get an impression of the connection between different variables, one can compute correlations, e.g., in the form of a correlation matrix.

If one expects one variable to affect another variable at a later time, correlation with a lag can be computed.

The degree of connection between two time series may also be dependent on time.

A Sliding Window Correlation (SWC) shows local correlation in time windows.

The window size (and possible lag) can be tuned for series of quick or slow changes.

Note: Correlation does not equal causation.

There may not be a cause and effect, even though two phenomena show similar patterns. Beautifully illustrated by Tyler Vigen.

The concept of Autocorrelation will be covered later.

PerEURO_ExpNatGas_corr = np.corrcoef(OilExchange['PerEURO'], OilExchange['ExpNatGas'])

PerEURO_ExpNatGas_corr_lagged = np.corrcoef(OilExchange['PerEURO'][10:], OilExchange['ExpNatGas'][0:len(OilExchange['ExpNatGas'])-10])

print("Correlation between PerEURO and ExpNatGas: {:.3f}".format(PerEURO_ExpNatGas_corr[0,1]))

print("Correlation between PerEURO and ExpNatGas lagged 10 timepoints: {:.3f}".format(PerEURO_ExpNatGas_corr_lagged[0,1]))

Correlation between PerEURO and ExpNatGas: -0.000

Correlation between PerEURO and ExpNatGas lagged 10 timepoints: 0.093

# Use ipywidgets to create a slider for the lag

from ipywidgets import interact

def lagged_correlation(lag=0):

x.index += lag

corr = np.corrcoef(y[lag:], x[0:len(y)-lag])

print("Correlation between {} and {} lagged {} timepoints: {:.3f}".format(x.name, y.name, lag, corr[0,1]))

x = OilExchange['ExpNatGas']

y = OilExchange['PerEURO']

interact(lagged_correlation, lag=(0,100,1)); # Semi-colon to suppress output

# Sliding window correlation with window size 45

PerEURO_ExpNatGas_SWC = OilExchange['PerEURO'].rolling(45, center=True).corr(OilExchange['ExpNatGas'])

# Plot PerEURO, ExpNatGas and PerEURO_ExpNatGas_SWC as subplots

def plot_SWC(center=22):

plt.subplot(3,1,1)

plt.plot(OilExchange['PerEURO'])

plt.plot(range(center-22,center+22), OilExchange['PerEURO'][center-22:center+22], color="red")

plt.ylabel('PerEURO')

plt.xlim(0, len(OilExchange['PerEURO']))

plt.subplot(3,1,2)

plt.plot(OilExchange['ExpNatGas'])

plt.plot(range(center-22,center+22), OilExchange['ExpNatGas'][center-22:center+22], color="red")

plt.ylabel('ExpNatGas')

plt.xlim(0, len(OilExchange['PerEURO']))

plt.subplot(3,1,3)

plt.plot(PerEURO_ExpNatGas_SWC)

plt.plot(center, PerEURO_ExpNatGas_SWC[center], 'r.')

plt.axhline(y=0, color='gray', linestyle=':')

plt.ylim(-1,1)

plt.xlim(0, len(OilExchange['PerEURO']))

plt.xlabel('Time')

plt.ylabel('SWC')

plt.tight_layout()

plt.show()

interact(plot_SWC, center=(22,len(OilExchange['PerEURO'])-23,1)) # Semi-colon to suppress output

<function __main__.plot_SWC(center=22)>

Note

If the lag approaches the length of the series, few points are included in the calculations.

Pandas’ rolling() and shifts#

When applying Pandas’ rolling() function, the index is used for matching the data points.

Therefore, we need to shift the index of the ExpNatGas to achieve a lag.

Because of the sliding window, the two series do not need to match in length.

OE = OilExchange['ExpNatGas'].copy() # <- Remember to copy, to avoid changing the original data!

OE.index += 10

plt.plot(OilExchange['PerEURO'].rolling(45, center=True).corr(OE))

plt.xlim(0, len(OilExchange['PerEURO']))

plt.show()

OE.index

RangeIndex(start=10, stop=189, step=1)

Exercise#

Combine lag and sliding window correlation.

Use ipywidgets to control:

window width

lag

selected variable to compare to PerEURO

bonus: visualize the sliding window like above

See also